Market Insights by Aseel Real Estate

“Dubai’s property boom won’t last—too much supply, not enough demand.”

You’ve probably heard this before. But let’s dive into the facts behind the talk.

Myth 1: Dubai’s Real Estate Market Is Flooded with Supply

At first glance, it might seem like Dubai is building too much, too fast. But if oversupply were a real issue, we’d see property values dip. Instead, the opposite is happening.

In 2024, prices are on the rise—driven not just by investors, but by genuine demand. Nearly 9,000 new villas are expected by year-end, yet the appetite for premium homes still outpaces availability. Dubai continues to attract high-income professionals, global entrepreneurs, and families looking for a safe, well-connected, and tax-friendly city to call home.

And here’s the kicker: Dubai may need between 37,600 and 87,700 new homes every year until 2040 to match its growing population. That’s not oversupply—that’s catch-up.

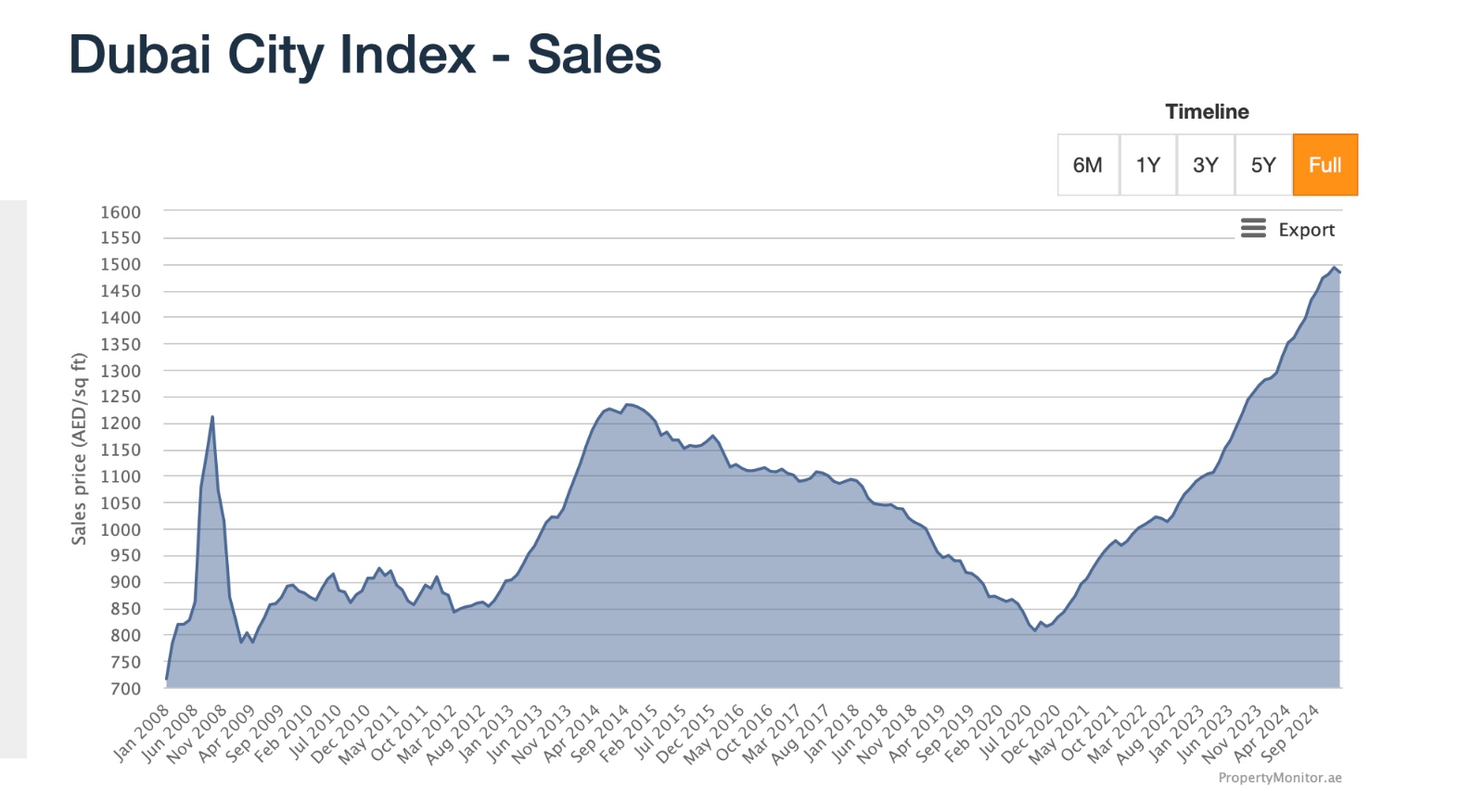

Myth 2: This Is Another 2008-Style Speculative Bubble

While it’s true that property flipping and fast gains are happening, today’s market fundamentals look very different from the pre-2008 era.

Here’s why:

-

Real rental yields are climbing alongside property prices.

-

End-user demand (not just investors) is fueling purchases.

-

Government regulations like stricter loan-to-value rules and higher transaction fees are designed to cool speculation and promote long-term stability.

Yes, any investment carries risks, but the 2024 market is more structured, transparent, and resilient than ever before.

Market Breakdown: Where Is the Growth Happening?

Luxury Segment: Soaring Demand, Scarce Inventory

Luxury real estate in Dubai is booming. In 2024 alone, there were over 435 transactions above $10 million, pushing Dubai ahead of most global cities.

Examples?

-

A record-breaking $275 million penthouse on Palm Jumeirah

-

A lavish $65 million villa in Emirates Hills

Why the surge? Limited supply. In Palm Jumeirah, less than 3% of land remains undeveloped. That scarcity is creating a premium—pushing prices up by 15% year-over-year in Q4 alone.

Off-Plan vs. Ready Properties: A Balanced Boom

Off-plan properties now account for 63% of all transactions in 2024. Buyers love the flexible payment plans and opportunity to secure units at today’s prices.

At the same time, the ready property market is holding strong:

-

Resale values are up 21%

-

Transaction volumes grew by 14%

This dual-track growth shows that both investors and residents are active—and regulations continue to keep market overheating in check.

Commercial Real Estate: Offices Are the New Hotspots

While homes dominate the headlines, Dubai’s office market is quietly exploding.

In contrast to global cities with empty office towers, Dubai is seeing Grade A occupancy rates between 95-97% in areas like Downtown, DIFC, and Business Bay.

Rental prices?

-

Business Bay: +44%

-

Downtown: +36%

-

Overall prime office rents: +25% YoY

Over 24,000 new businesses registered in just the first half of 2024, fueling demand for top-tier office space as Dubai becomes a magnet for international firms.

Dubai in a Global Context: The World Is Watching

Globally, property markets cooled in 2024—but not in Dubai. The emirate posted one of the highest luxury price growth rates worldwide at 16-17%, outpacing major hubs like London and New York.

Rental returns are another highlight:

-

Dubai: 6-8% gross yields

-

New York: ~4%

-

London: ~2-3%

Plus, Dubai still offers competitive prices per square foot, making it a compelling investment destination—even for first-time international buyers.

Looking Ahead to 2025: A Healthy Slowdown?

After a two-year run that saw prices climb more than 50%, what’s next?

Most analysts predict continued growth, but at a calmer, more sustainable pace.

-

Knight Frank forecasts 8% price growth in 2025 (down from 19% in 2024)

-

The luxury market may see a modest 5% gain

With 72,000+ residential units expected to be delivered next year and Dubai’s “D33” strategy aiming to double the economy by 2033, the foundation for long-term success is solid.

Conclusion: Boom or Built to Last?

2024 showed us that Dubai’s real estate market isn’t running on hype—it’s fueled by fundamentals.

-

Luxury buyers are still arriving

-

Regulations are working

-

Commercial and residential sectors are thriving

As we move into 2025, the pace may ease, but the momentum is real. Investors who do their homework and stay focused on long-term value will find Dubai remains one of the most exciting real estate markets in the world.